When you sell a gift voucher, new package or issue a customer credit, you are creating a liability or obligation to that customer to the value of the money received.

- What is a liability?

- Liability vs Revenue in Timely

- Redeeming vouchers, customer credit or new packages

- New packages tax and customer liability

- How can I work out how much liability I have outstanding?

- Accounting for liabilities with integrations

What is a liability?

A liability is a promise or obligation to your customer. It usually indicates that you have received money from a customer on the understanding that you will reimburse them, or deliver a service or product, at a later date. A liability is reported on a company's balance sheet, as opposed to on your Profit & Loss statement.

A good analogy for business liability is to think of a bucket:

- Every time a voucher is purchased, customer credit or new package is issued, a cup of water is put into the bucket. This increases your liability amount.

- Whenever a voucher, customer credit, or new package service is redeemed, a cup of 'water' is then removed from the bucket, reducing your liability.

Liability vs Revenue in Timely

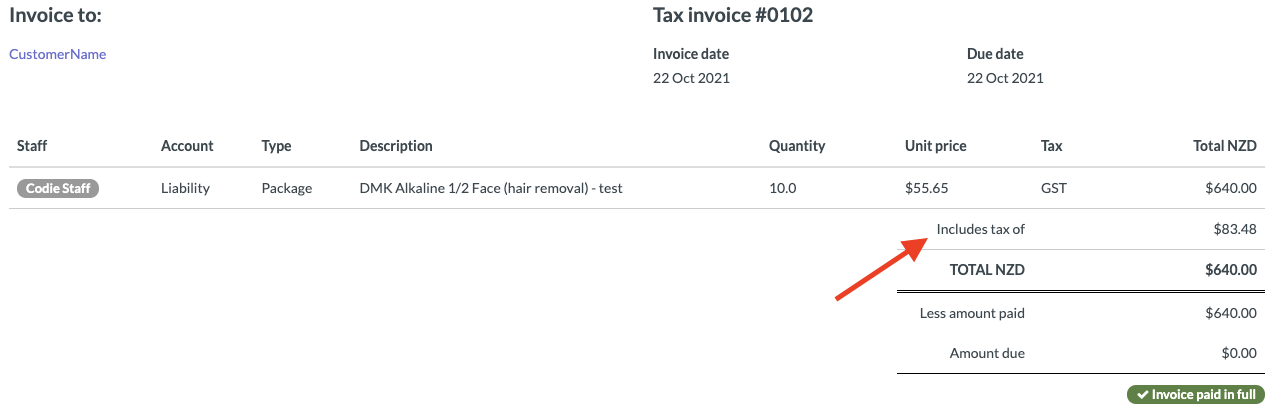

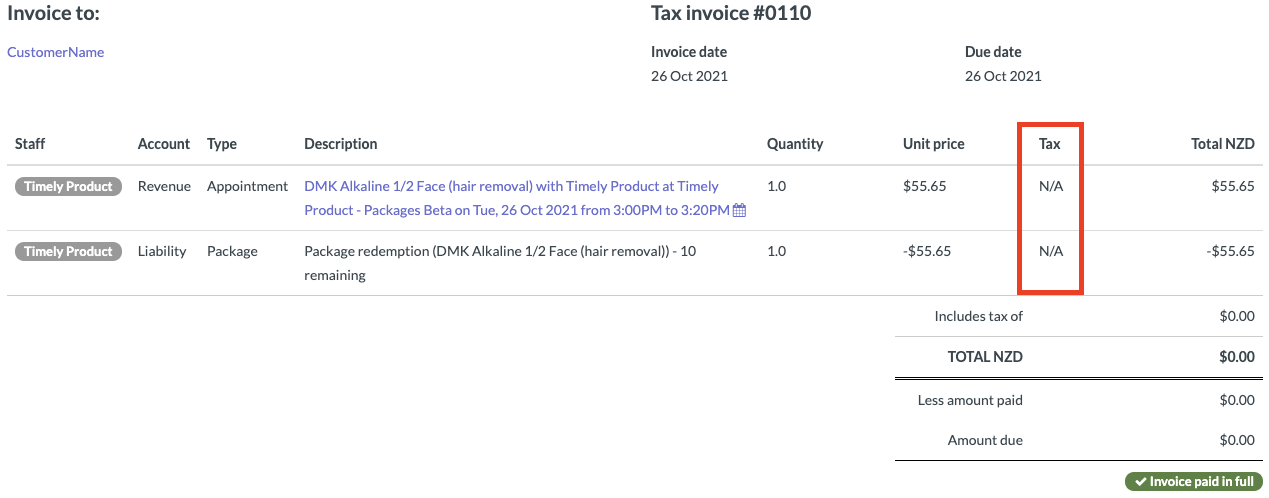

When viewing an invoice, you will see a new column for 'Account' which indicates whether or not the invoice item is a Liability or Revenue.

When you sell a voucher, issue the customer credit or new package this will be shown as a Liability on the account:

What does this mean for my Sales reports?

As the goods/service haven't been delivered to the customer, we don't recognise this transaction as a sale (yet). This means that any gift vouchers, customer credit, or new packages issued will not be included in your sales reports/figures.

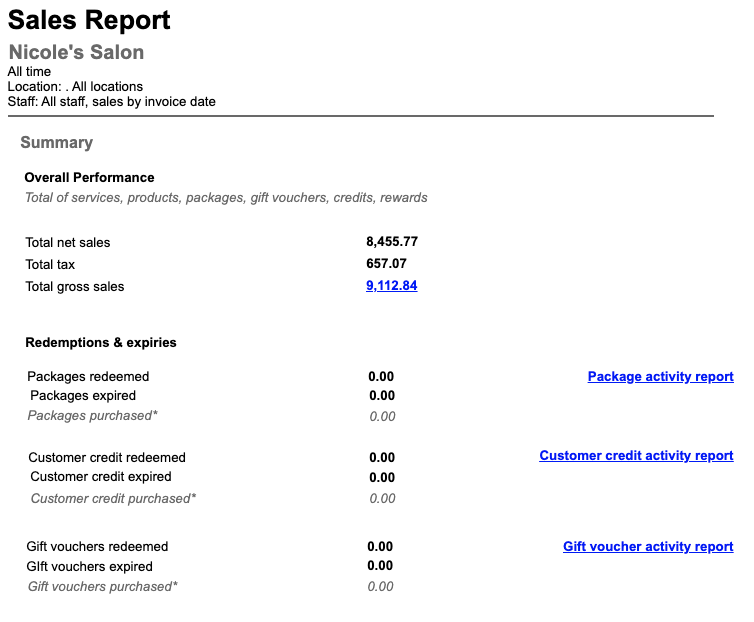

However, we have added a section to the Sales report, which indicates the value of redeemed, expired and purchased gift vouchers, customer credit and new packages during that period.

Redeeming vouchers, customer credit or new packages

When you redeem a gift voucher, new package or customer credit against an invoice, two things happen:

- Your liability balance is reduced.

- You record the sale of the services and/or products to the customer.

The liability reduction is reflected on the invoice by a negative value as below:

In this scenario, the service or product on the invoice will be treated as revenue. This is what will be accounted for in your Sales reports. This means the sale isn't accounted for until the service has been delivered/ completed and checked out in the Timely app.

New packages tax and customer liability

The tax is associated with the new package (not the individual package services) and is accounted for when issuing a new package:

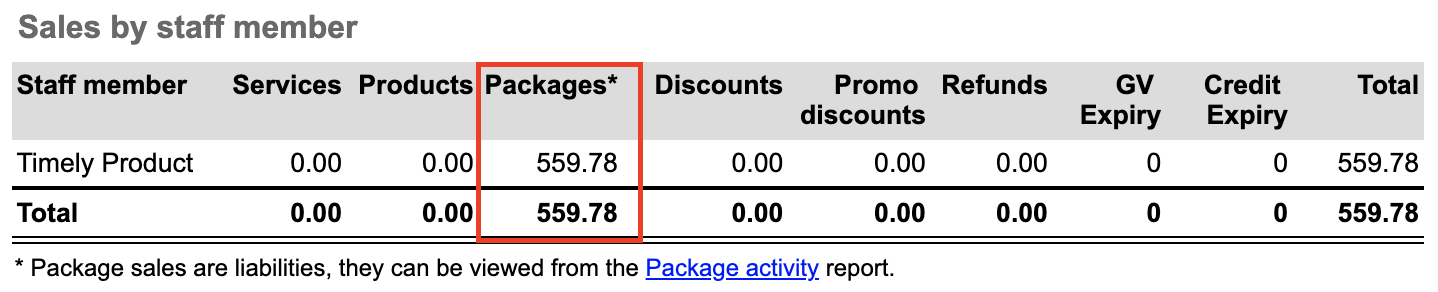

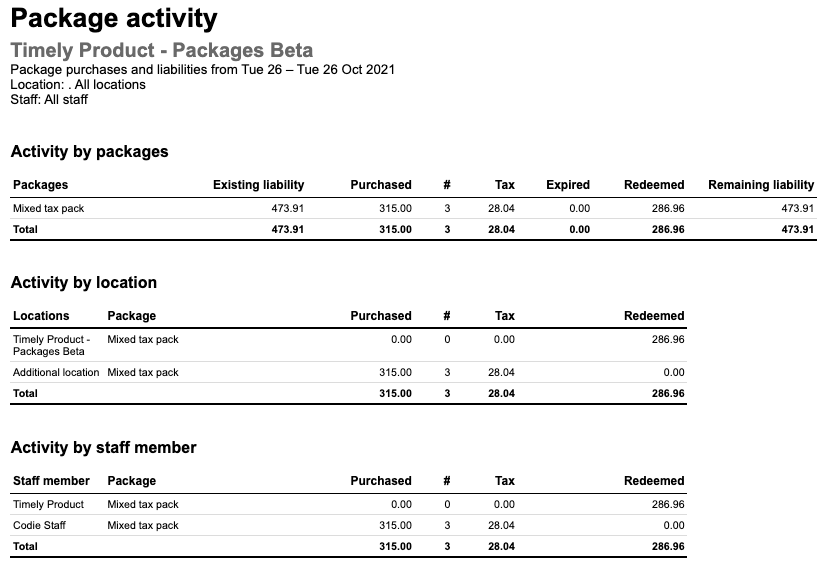

When selling a new package, the tax value is displayed as part of the purchased value on the package activity report and the packages sales value on the sales report:

The package tax isn't relevant when booking or redeeming a new package service:

How can I work out how much liability I have outstanding?

For Gift vouchers:

Head over to the Customer gift voucher details report and run it for the desired time period. The 'Outstanding' column shows the total value of those gift vouchers, which is the liability for that period:

For Customer credit:

Head over to the Customer credit details report and run it for the desired time period. The 'Outstanding' column shows the total value of any outstanding credit, which is the liability for that period.

For new packages:

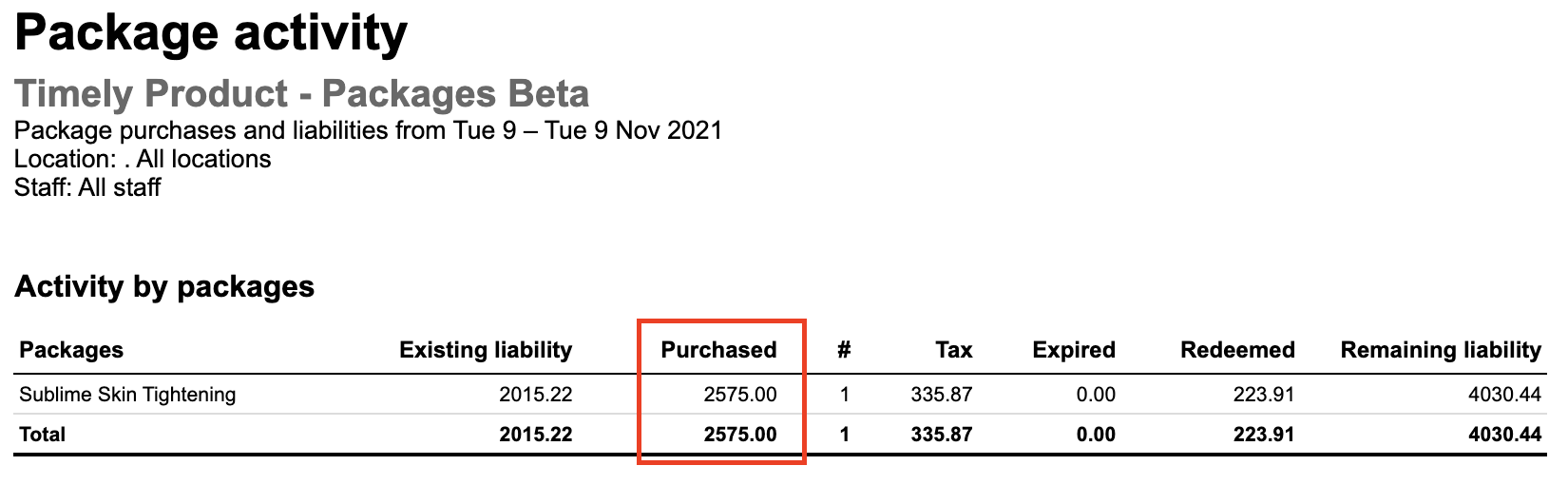

To find out your outstanding liability for new packages, run the Package activity report. This report shows your opening/existing liability, and all activity that occurred during the period.

You can see the following activities per package:

- Purchased: Value of packages purchased (increases liability balance)

- Tax: Shows the tax amount for that package

- Expired: Value of packages that have expired (reduces liability balance)

- Redeemed: Value of packages that have been redeemed (reduces liability balance)

- Remaining liability: Value of remaining liability for that package. You can also see the grand total of the remaining liability.

The package activities (value purchased, tax, and value redeemed) are also shown by location and staff member.

Accounting for liabilities with integrations

If you are using one of our accounting integrations, check out our guides for more information on working with liabilities: