Financial reports in Timely show your earnings based on invoices raised for your appointments, packages, and product sales. If your reports aren't showing any data, you'll need to make sure you are raising invoices for your appointments.

- Using the financial reports.

- Sales report.

- Service sales report.

- Product sales report.

- Transaction Summary report.

- Invoice detail report.

- Unpaid invoices report.

- Customer product sales report.

- Stock levels report.

- Stock movement report.

- Deposits report

These reports may not be available on your current plan. Find out how to upgrade in our How to change your Timely plan guide.

Using the financial reports

For a large majority of the financial reports, you will be able to filter the report based on the Date range, Location and the Staff member.

An invoice will be included in a reporting period ( Date range) based on the Invoice date.

When you raise an invoice, the Invoice date will automatically be set to the day the invoice is raised, not the date of the appointment. This will be something to take into account, especially if you accept deposits or take online payments for appointments.

You can adjust the Invoice date when you raise or Edit an invoice, to set this as a past or future date. Just click on the current date and choose the new date from the date picker:

Example: If an invoice has an Invoice date in October, but the appointment itself isn't until November, then by default, the invoice will be included in the October's reporting.

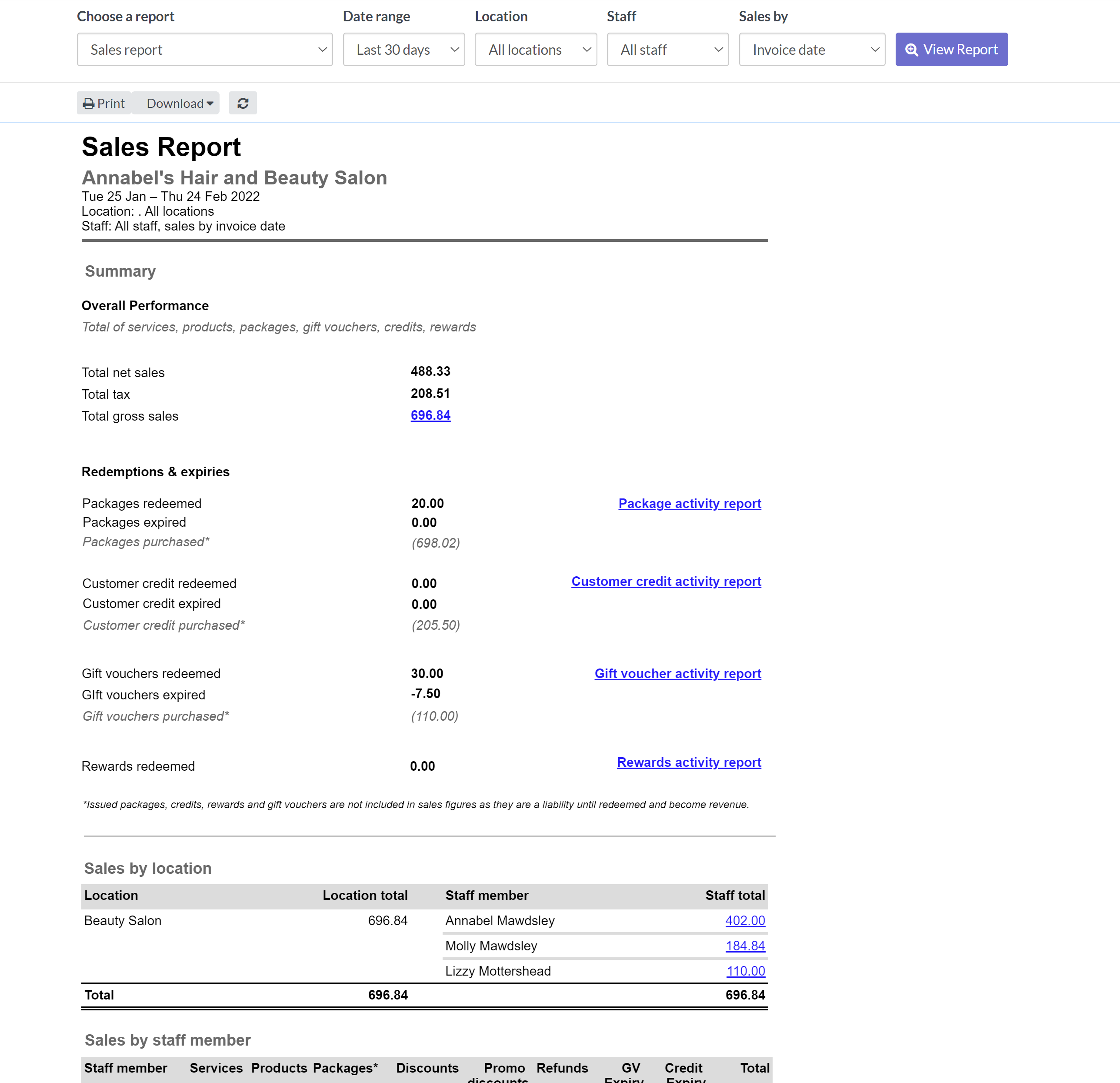

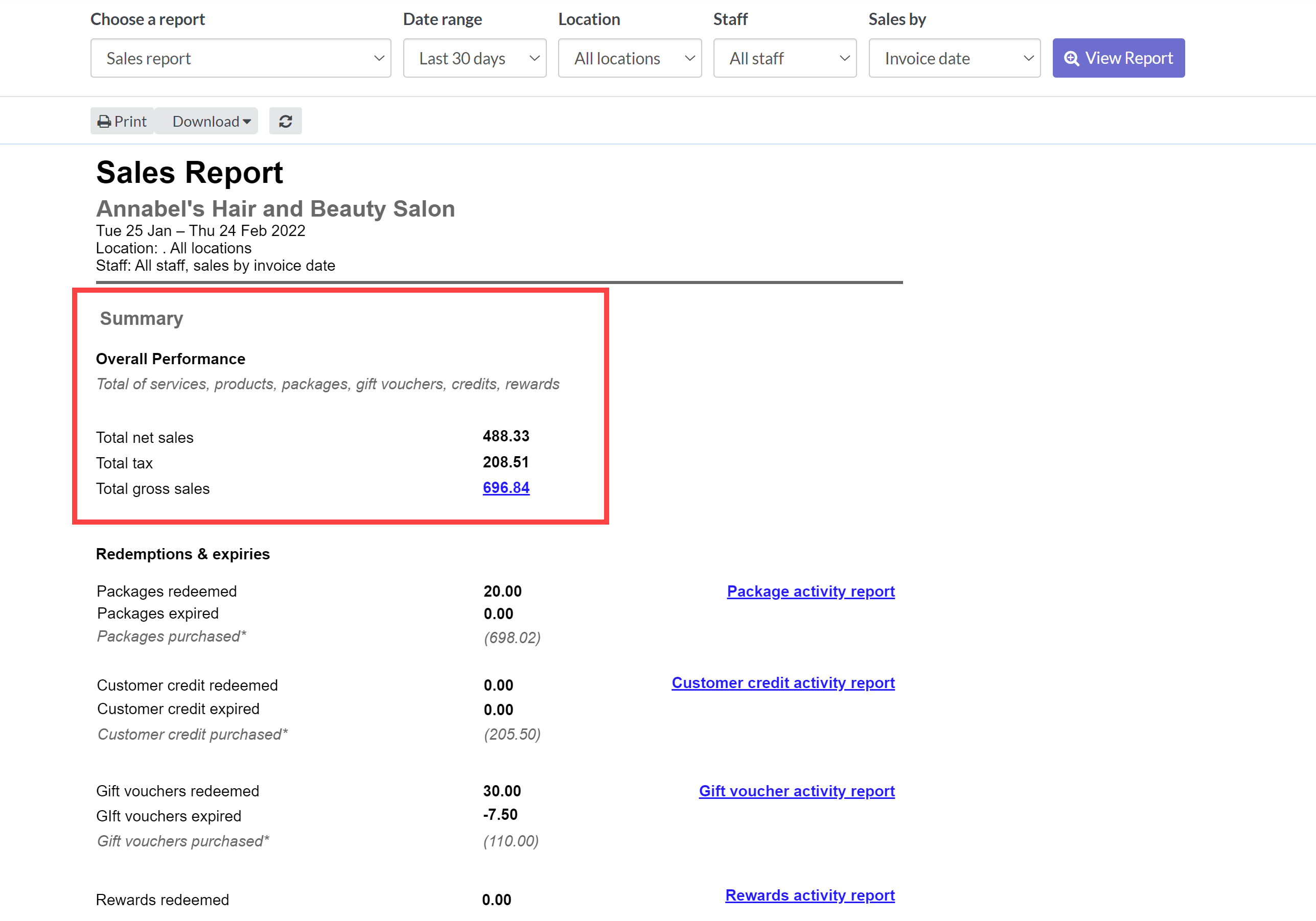

Sales report

This report is a summary of the total sales value for your bookings, products and discounts within a selected timeframe.

You can view an overall summary of sales, which will include a summary of your total income, including tax collected, for that period:

Sales will then be broken down into Sales by staff member and Sales by location, as well as Booked service sales, Walk-in service sales, Product sales, Package sales, Standard discounts and Promo code discounts given.

The Sales report is based on the value of all invoices raised, which will also include any Unpaid invoices. So this is something to take into account when using this report.

You can also run the sales report by appointment date, this will help you accurately report on sales where you have received a deposit on an earlier date.

Note: The numbers shown in the Sales report will be inclusive of any tax, but you will be able to see at the top of the report, a handy figure that shows you the total amount of tax collected during this period:

See detail of what invoices are included in Sales report figures

- If you'd like to see what invoices are making up the totals on your

Sales report

- , simply click on the hyperlinked values. This will load the

Invoice detail

- report, filtered by the exact invoices that made up your sales totals.

Service sales report

The Service sales report goes into more depth on your sales split out by service. You can see the total sales for each service sold during that period, as well as tax totals and category splits.

- This report is great for identifying which of your services is performing the best, as well as being able to see a percentage split between your services (this includes both booked and walk-in services).

Services that were booked in the calendar will be shown under the Booked service sales section:

Walk-in or "Add on" services that have been sold directly to the customer on the invoice, without being added to the calendar, will be included in a separate Walk-in service sales section:

You can also run the service sales report by appointment date.

Product sales report

View a summary of the total sales value for products sold. This includes their current stock levels, tax totals and splits by product type.

Note: The Product Sales report currently does not report on discounts.

Transaction summary

The Transaction summary will record the details of any payments received within a specific date range.

Payment type summary

- This section shows a summary of the totals for each payment type, and a total payments for the period.

List of payments

- This shows a list of every individual payment received during the date range. You can see the invoice the payment is linked ot, the payment type, payment date, who processed the payment, the register the payment was made against, the location of the sale the payment is linked to, the customer name (and link) and the payment amount. This is perfect if you need to balance your till or terminal at the end of the day:

You might have noticed a different staff selector on this report, which is the Processed by field.

You might have noticed a different staff selector on this report, which is the Processed by field.

When a payment is applied, we will record the staff member who was logged in and applied the payment to the invoice. This means that the staff member who is assigned the original invoice/sale won't automatically be assigned that payment.

You can adjust the Processed by field to another staff member while applying the payment:

Did you know? You can create your own payment types, in addition to the default payment types provided. Check out our guide for more information: http://help.gettimely.com/article/278-how-to-create-your-own-payment-types

Invoice detail

This report shows a detailed list of all the bookings, products, packages and vouchers that have been included in the Sales report for a specific period. This allows you to easily identify what invoices have been raised during this period and attributed to staff.

- You can filter this report by location, staff member and by which items you'd like to include in the report e.g. Everything or just Classes, Products, Appointments, Services, Discounts, Promo discounts or Packages:

Unpaid invoices report

This report allows you to see list of all of your unpaid invoices, with due dates and customer details. You can filter the report on date (sales are included based on the Invoice due date) and by location.

Once the report has been run, you can sort the results based on any of the column headers e.g. invoice date, due date, first name/last name etc.

To view the sale in question, you can click on the invoice number in the left-hand column.

Customer product sales

This report shows what products your customers have been buying, the quantity they have bought of that product and the total value. The report also links to the invoice that the product was sold on:

Stock levels

The Stock levels reports shows a list of all your current retail and professional stock levels. You can filter this report by Location and by Stock type (Retail vs Professional).

You can see a summary of the products, by location, at the top of the report. You can then sort the report on any column, but ascending or descending order.

You'll be able to see the Cost price per item, as well as the Total cost value of sold products. This is great if you need to keep track of the cost price of consignment items.

Sales and invoice figures are based on the Invoice date (the date that the invoice was raised), not the date the appointment/class took place. This is something to bear in mind if you take online payments for bookings. You can amend the Invoice date at any time, as required.

Stock movement report

The Stock movement report allows you to track any changes in stock levels within a certain date range.

This gives you a list of all your retail products and internal stock, then details their starting level and any Increases or Decreases during that date range.

Deposits report

The Deposits report shows you a list of appointments for a given date range, and what deposits have been paid against those appointments.

Note: This report only reports on our new deposits feature. Find out more here.