Online deposits are a great way that you can get real commitment from your client and ensure that you are paid for your time. In addition to requesting full payments for online bookings, a partial deposit can also be requested. You can also request deposits for appointments booked from the calendar.

This feature may not be available on your current plan. Find out how to upgrade in our How to change your Timely plan guide.

There are two different ways to calculate deposits:

Percentage based

This option will calculate a percentage of the appointment total at the time of booking.

E.g. If 10% deposit is required and the total cost of the appointment is $80, then the customer will need to pay $8 to complete the online booking.

Fixed amount

Customers pay the same deposit amount regardless of how much the total cost of the appointment is.

E.g., If $25 is specified then the a deposit amount of $25 will always be requested, unless the service is less than $25.

In this guide we'll cover:

- Turning on customer deposits.

- Your clients' experience

- Viewing a deposit.

- Checking out an appointment with a deposit.

- Deposits in your reports.

Please note: before you can start taking online deposits you will need to set up a payment gateway. We recommend TimelyPay for the best online deposit experience.

-

Turning on customer deposits

-

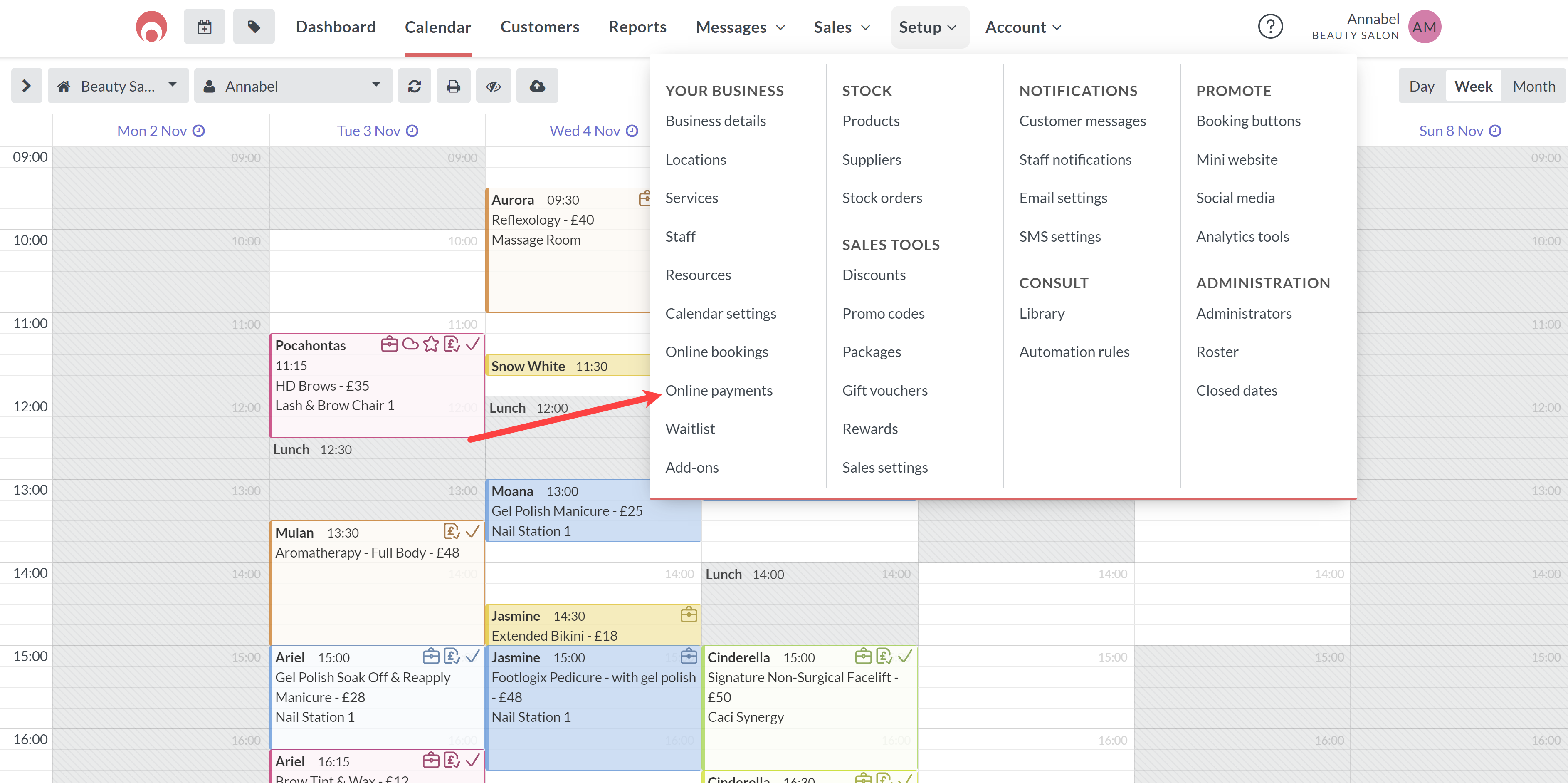

- Go to Setup, then click Online payments.

- Go to Setup, then click Online payments.

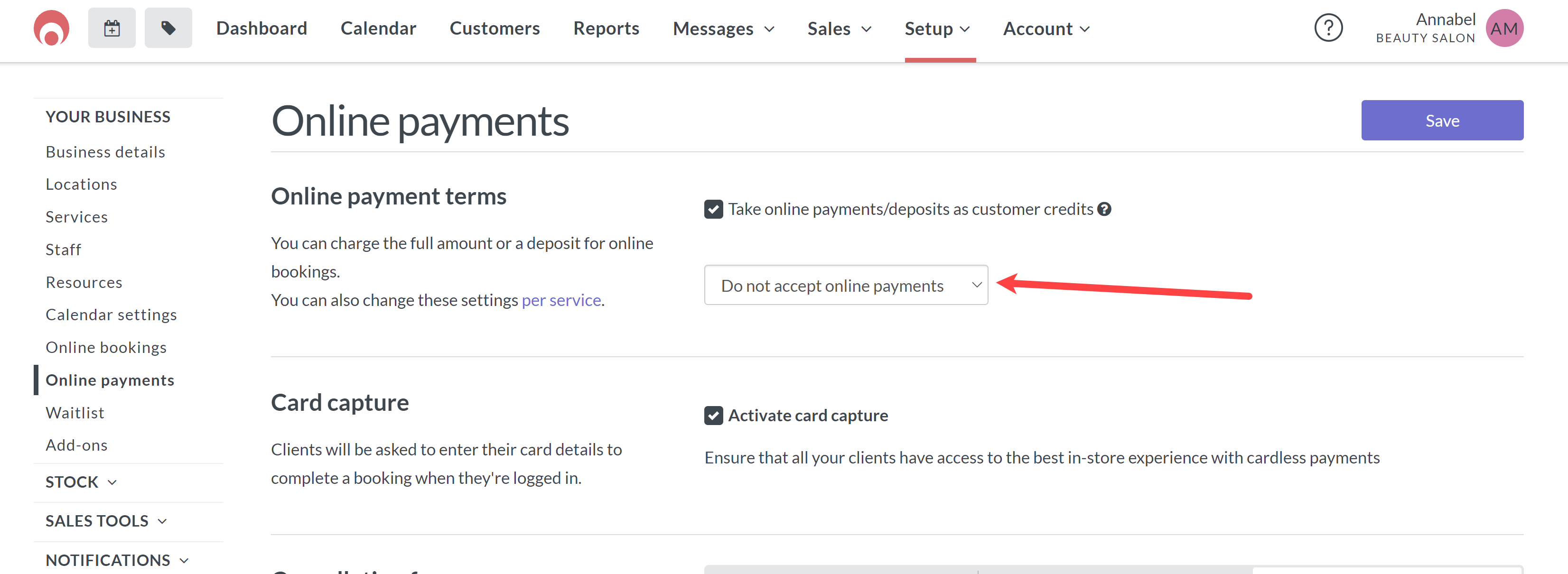

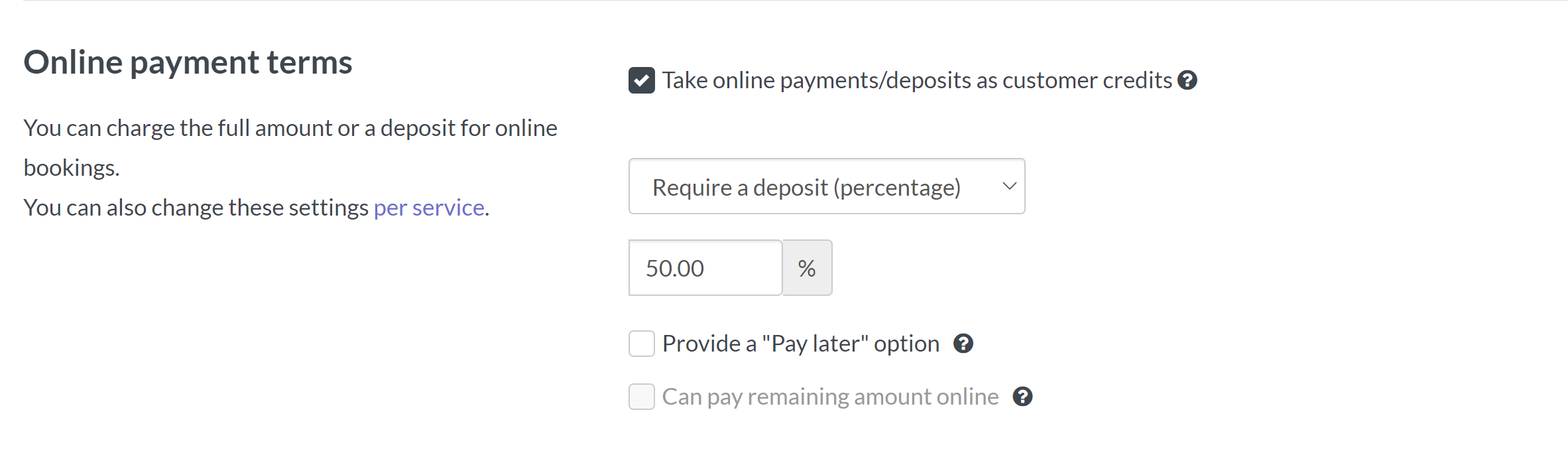

- Go to the Online payment terms section and click on this drop down menu:

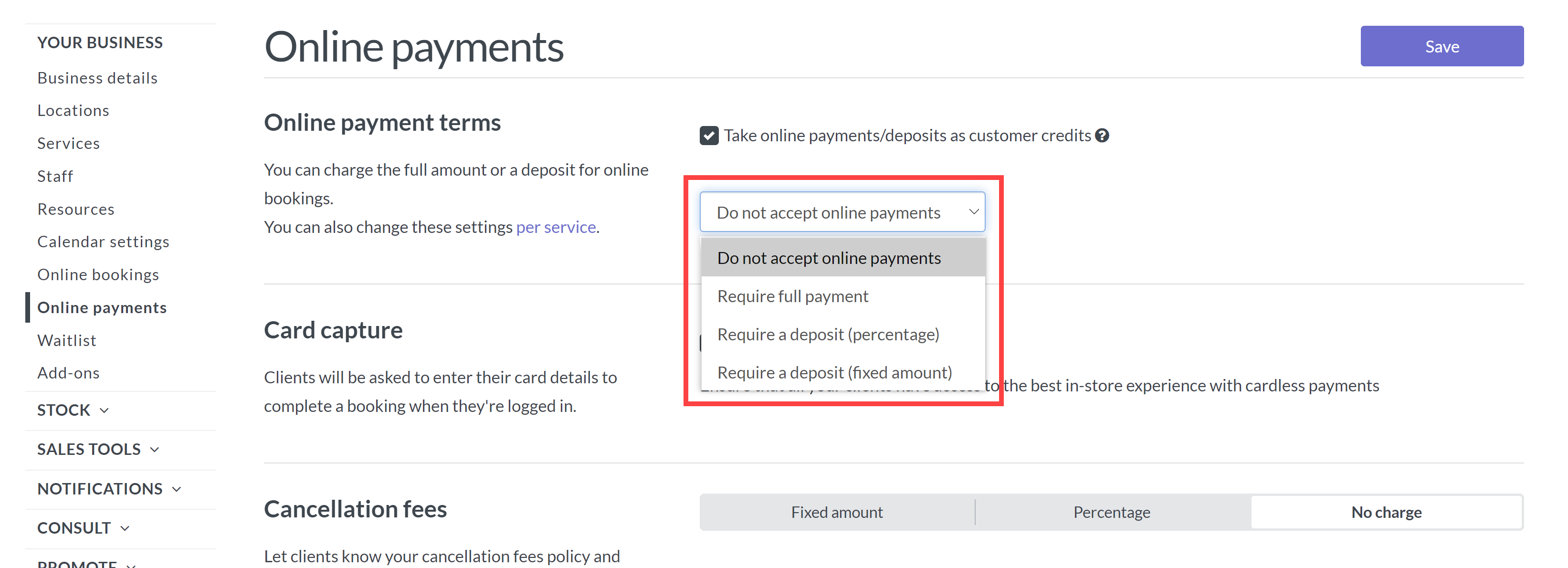

- Choose your preferred deposit option:

- You'll then have some additional options:

- Enter the deposit value (the percentage or the fixed amount):

- Determine if you would like to Provider a "Pay later" option for customers.

- If you want customers to be able to pay the remainder of the balance online, check the box next to Can pay remaining amount online.

- Click Save to apply.

Note: When a customer is booking more than one service through the online booking process while deposits are in place, the deposit is payable per service rather than for the overall price of the booking. E.g. If a £10 deposit is in place, the total amount of the deposit the customer will need to pay is 1£10 per service.

-

Your clients' experience

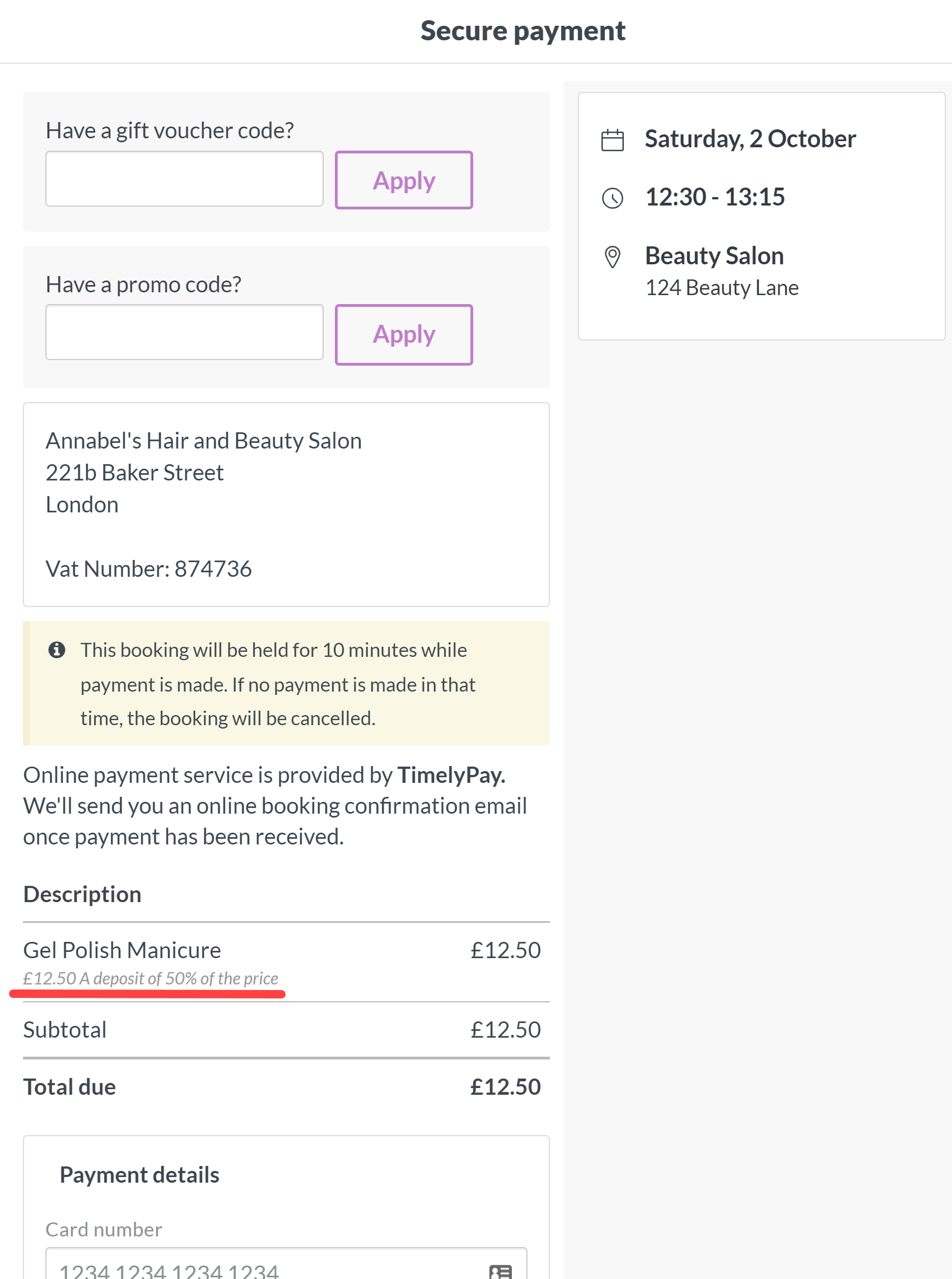

- When customers are booking their appointment, or class, online they will be prompted to pay a deposit. After customers enter their details and choose Next they are prompted to make a payment:

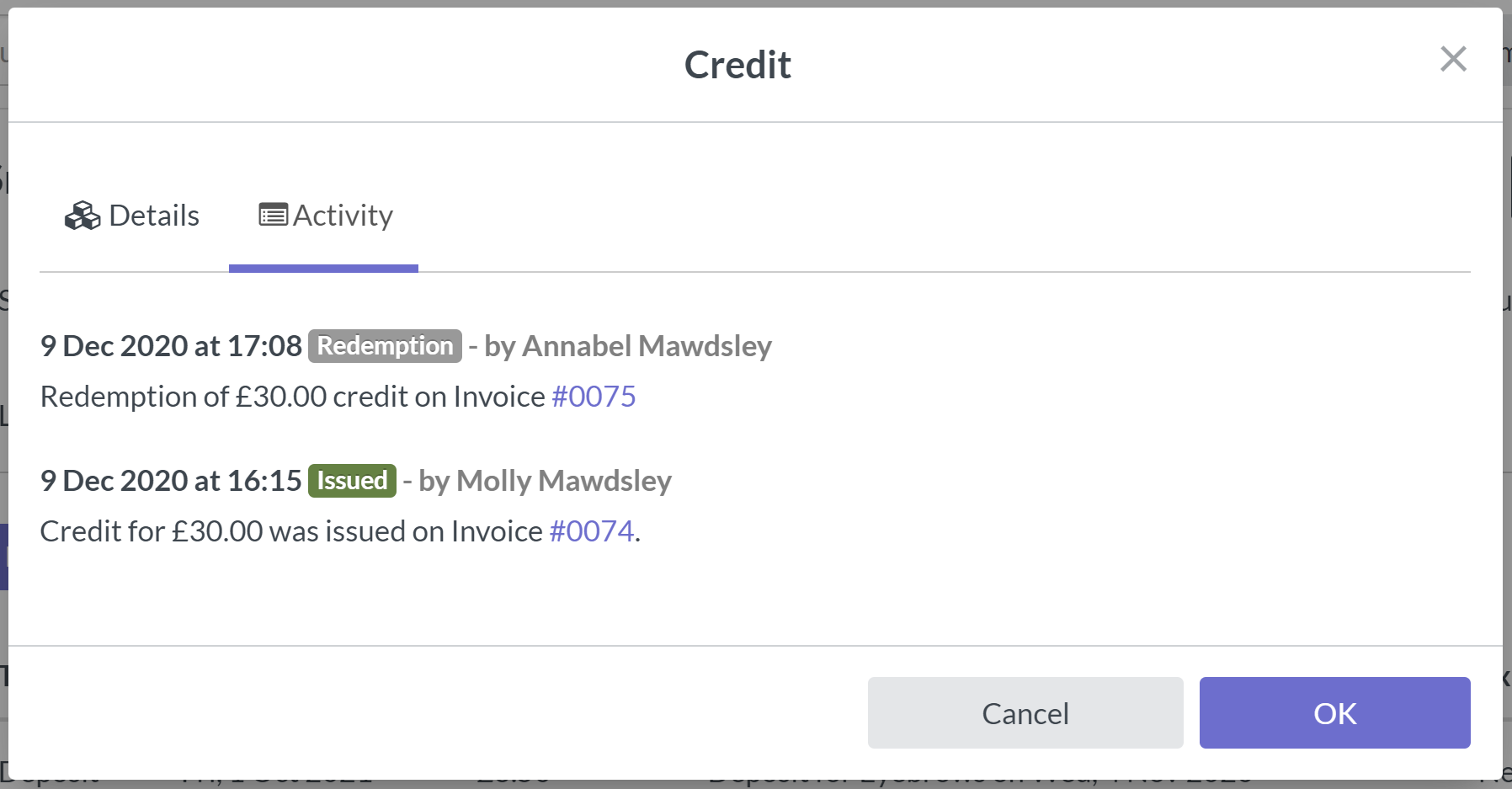

- Once the payment is completed successfully, the appointment is confirmed and an invoice is created on Timely. The deposit will be applied to the invoice as a payment and will show the remaining balance owing.

- When the customer arrives for their appointment, a manual payment can be applied to the invoice so that the customer pays the difference. Or, you can allow customer to pay the remainder of their balance online (see above). Deposits can also be deferred like full payments (see above).

-

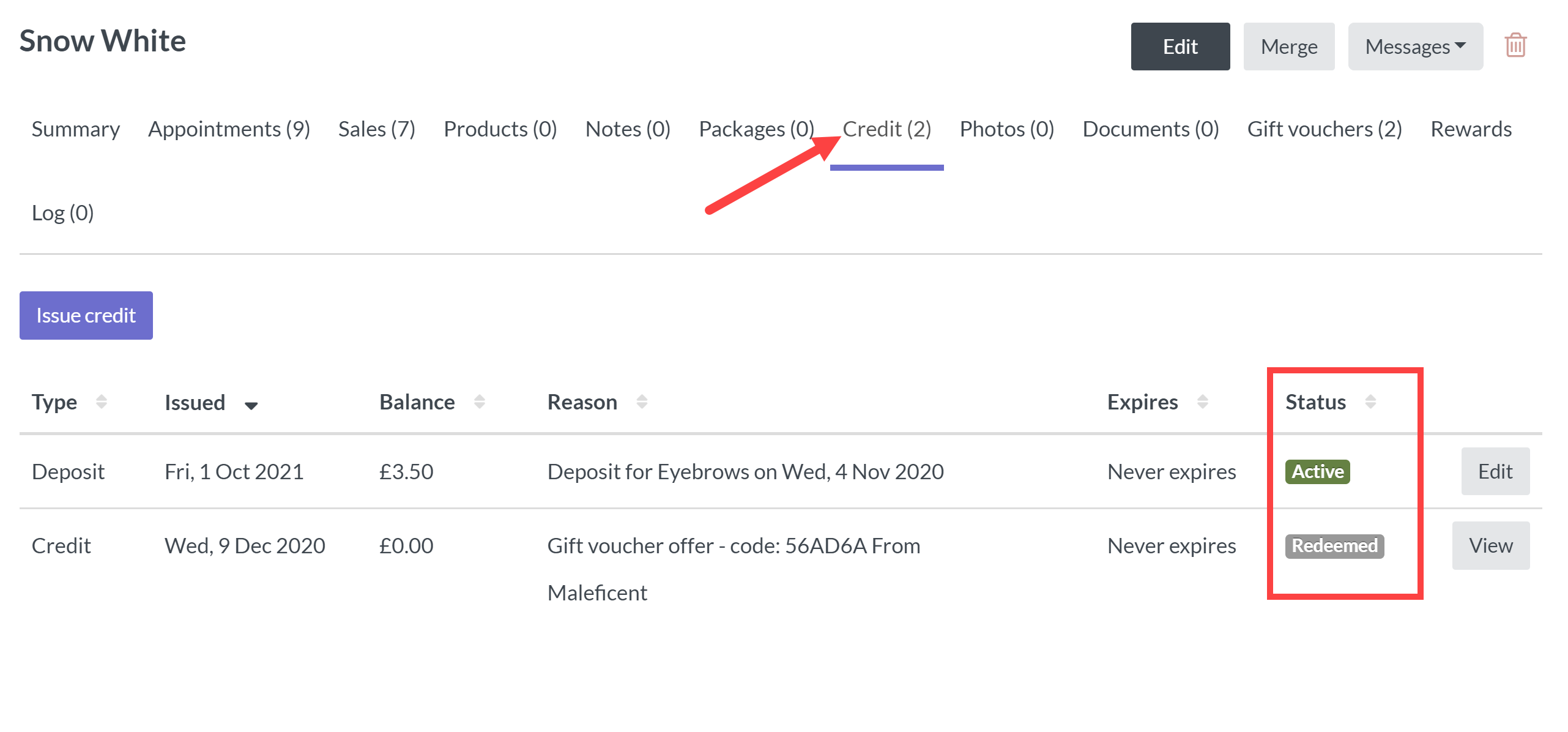

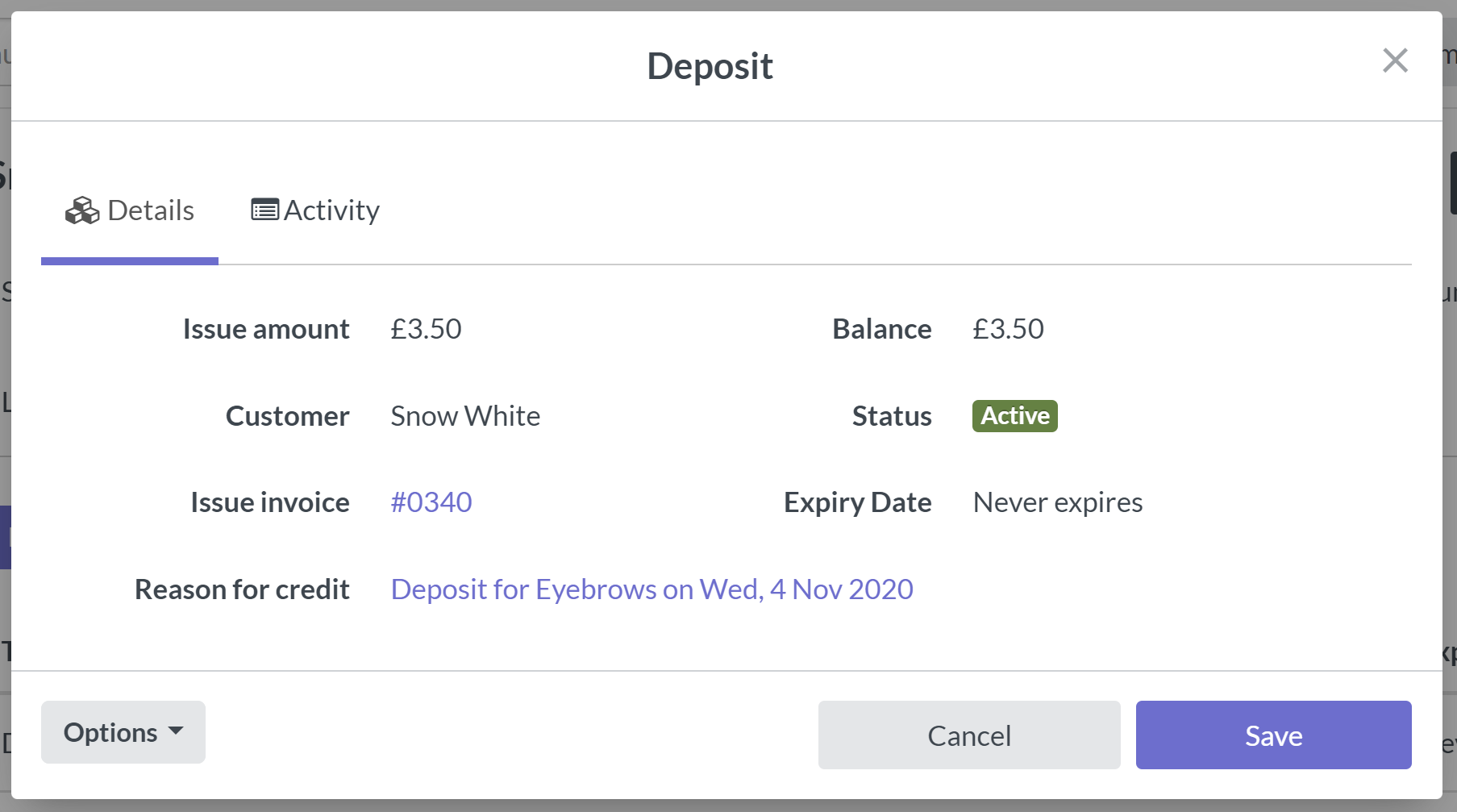

Viewing a deposit

- Show the deposit amount paid on the calendar popover

- Show up on the appointment details screen

-

Checking out an appointment with a deposit

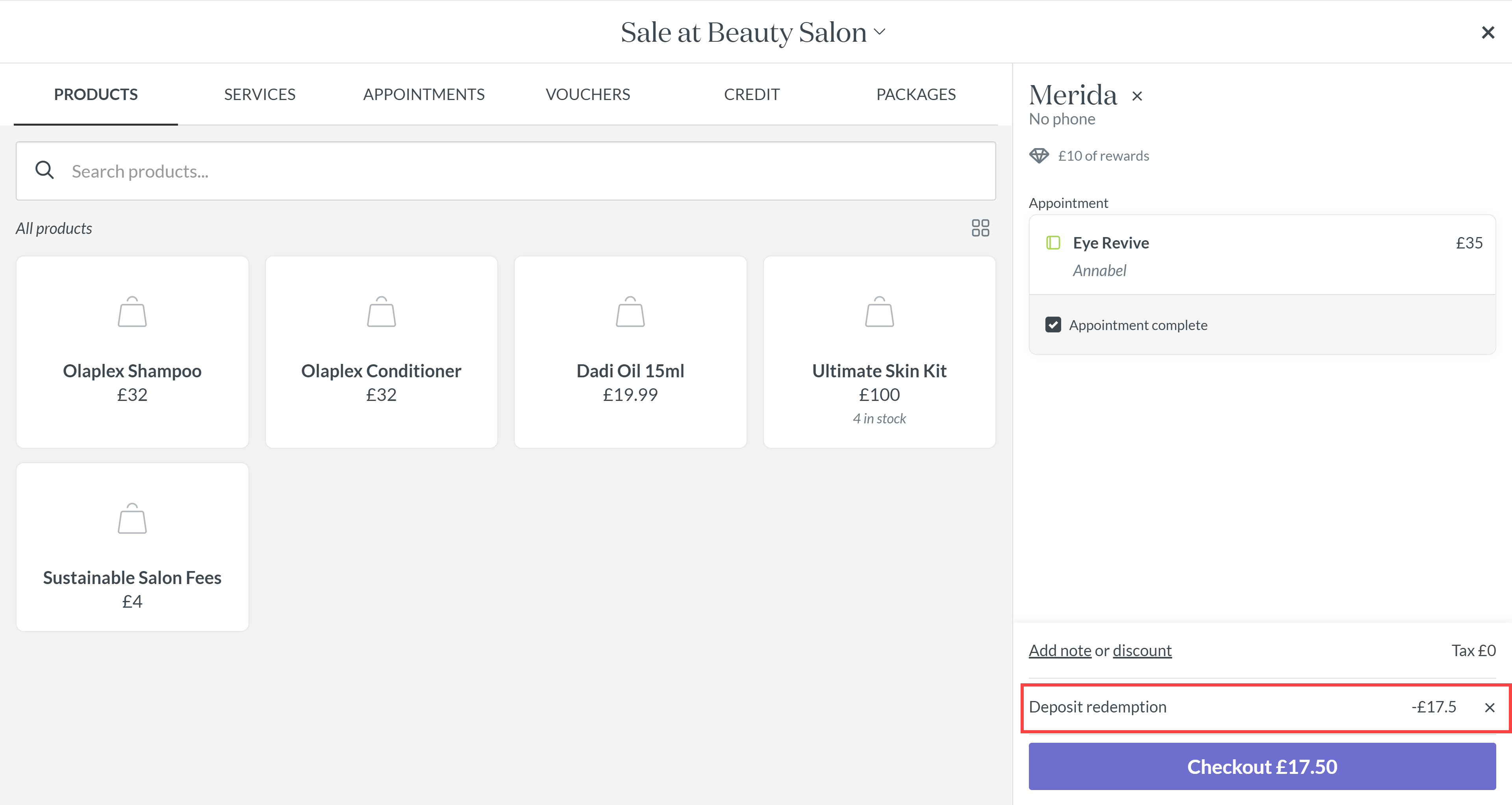

- Checkout is painless, simply click on checkout from the calendar and a new sale will be raised with the deposit appearing automatically!

- If the deposit covers the total value of the appointment, just click save and you are done. Otherwise, after clicking checkout you will then have the opportunity to add additional payments as normal.

- Once the deposit has been used during checkout, the value of the credit will no longer be viewed as a liability within Timely and will show up as revenue in your sales reports when they include the sale that the deposit was used on.

-

Deposits in your reports

For more information liabilities, see Understanding liabilities versus revenue